ECONOMICS STUDY CENTER, UNIVERSITY OF DHAKA

|

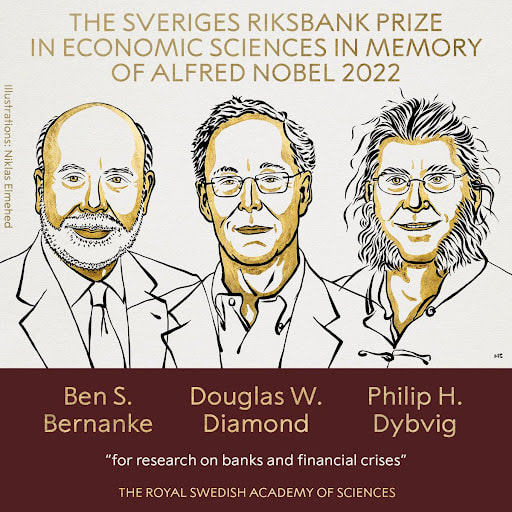

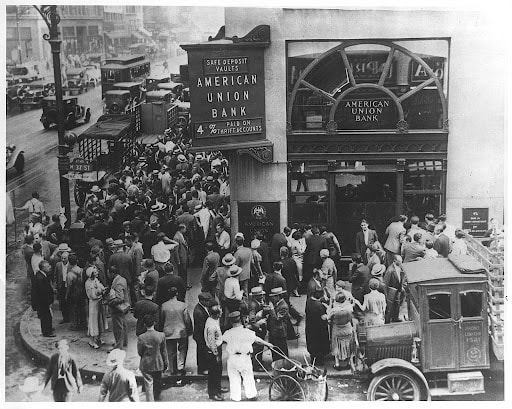

Md. Takrim Hossain, Sharika Sabha Design: Amirus Salehin Ha-meem The 2022 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel was awarded to Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig for their research on banks and financial crises. Bernanke’s paper, for which he received the award, attempted to explain the Great Depression. That the financial system can be a driver of economic activity and unemployment was not conventional back then. But his paper, which essentially dealt with the idea of bank credits, stated that banks fail due to bank runs, which results in an aggravated financial crisis. Whereas, the Diamond-Dybvig model, a widely used model of bank runs and associated financial crises, shows that banks work as an intermediary to resolve the conflict between the demands of savers and investors. The model explained that to prevent bank runs, there should be a guarantee—a deposit insurance scheme. Our understanding of banks, bank regulation, banking crises, and how to manage financial crises has been greatly improved because of the work for which Bernanke, Dybvig, and Diamond are now being recognized. Let’s take a closer look at the idea of bank runs, the research of Bernanke, Diamond, and Dybvig that led to their awards, and the significance of their findings. Bank Runs A bank run occurs when a considerable number of customers of a certain financial institution or bank begin withdrawing deposits out of their accounts out of concern that the bank may soon run out of money. Imagine that the majority of your savings are deposited in a nearby bank. You find out that the bank is out of funds and unable to conduct withdrawals. How would you respond? If you're like most people, you'd rush to the bank and demand your whole savings. A large number of withdrawals in a short period might exhaust the bank's cash reserves, forcing it to close and possibly forcing it out of business because the cash reserve a bank has on hand is only a small portion of its deposits. Even solvent banks—those whose assets are more than their liabilities—can fail if they are unable to turn their assets into cash quickly enough (and with little loss) to meet the demands of their customers. This describes a bank run. Bank runs date back to the beginning of the banking system. Due to poor harvests, English goldsmiths who issued promissory notes experienced significant failures starting in the 16th century, sending several regions of the nation into starvation and turmoil. The Great Depression is frequently linked in modern history with bank runs. Following the 1929 stock market crisis, American depositors started to panic and turned to hoarding actual cash as a safety net. The first bank failure caused by widespread withdrawals occurred in Tennessee in 1930. Figure: American Union Bank, New York City. April 26, 1932. Source: The National Archieves Deep into Bernanke’s research Ben Shalom Bernanke is widely known for his role as the Chairman of the United States Federal Reserve during the financial crisis of 2007-2009 (the Great Recession). However, his 1983 paper, “Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression,” published in the American Economic Review, is the work that led him to recognition. In contrast with the established idea, his paper presented that developments in the financial system can have important macroeconomic effects. They can affect the business cycle, as well as can create major crises. Through his systematic analysis of empirical data retrieved from the Great Depression period, he showed that the effect of bank failures and credit crunches cannot be mitigated through market mechanisms as banks serve more purposes than being just an intermediary between savers and borrowers. If a bank’s central role of making the credit market work fails, the supply of credit freezes up, and loans become more expensive or unavailable. The contraction of credit will hit households, farmers, and small businesses that are dependent on bank loans hard, particularly harder than large business entities which have more options to earn credit. When bank runs continue for a long time, at a mass level, the overall level of economic activities plunges as well. Since banks require more time to re-capitalize, economic growth delays for a longer period, causing severe economic crises as was evident in the Great Depression. Unravelling Diamond and Dybvig’s research The researchers Douglas Diamond and Philip Dybvig demonstrated that organizations designed just like banks are the most effective at resolving some underlying issues related to banking. In a 1983 article, Diamond and Dybvig presented a theoretical model that clarifies how banks produce liquidity for savers while providing access to long-term financing for borrowers. Although this model is quite simplistic in nature, it covers the basic functioning of banking, including both how it functions and how it is fundamentally unstable and, hence, requires regulation. The model assumes that households will save a portion of their income and will need access to their funds whenever they need it. Nobody can predict whether or when they will need money, yet not every household experiences financial need at the same time. There are investment initiatives that require financing in the meantime. Although these initiatives are profitable in the long run, the profits, if they are abandoned early, will be relatively small. In a society without banks, households are required to invest directly in long-term initiatives. Households with immediate financial needs will be forced to stop the projects early, which will result in very poor returns and leave them with little money for consumption. Diamond and Dybvig describe how banks naturally develop as intermediaries and offer a solution. Families can deposit money into their accounts at the bank. Long-term projects are then given loans using the money. Depositors can take their money out whenever they like without suffering the same losses as if they had invested directly but stopped the project early. Implications of their findings Bernanke’s achievement, however, met with criticism, as he is one of the few academics who had the opportunity to exercise his concept of financial institutions and economic crisis in the field. Although he failed to predict the Great Recession at the beginning of his 8-year tenure (2006 - 2014) at the US Federal Reserve, his responses to the crisis were innovative and timely. Expanding access to deposit insurance and Fed lending, effectively nationalizing companies, and brokering the acquisition of failed banks - he solidified the ideas of his paper through a unique implementation during the crisis. His paper made a breakthrough by relating real-world problems with economic theories, and his work already is a testament to that. With the help of Bernanke's assessments of financial crises, we now have a better understanding of why regulation occasionally fails, the size of the effects, and what nations may do to avert an imminent banking crisis. The theoretical insights of Diamond and Dybvig regarding the significance of banks and their inherent fragility form the basis for current bank regulation, which tries to establish a stable financial system. In the early 2000s, new financial intermediaries that, like banks, made money on maturity transformation began to appear outside of the regulated banking sector. The severe financial crisis of 2008–2009 was largely caused by runs on these shadow banks. Although in actuality, regulation cannot always keep up with the quickly changing structure of the financial system, Diamond and Dybvig's ideas function equally well for analyzing such events. Researchers and policymakers are still debating how to manage the financial markets to fulfil their purpose of directing funds to profitable investments while preventing recurrent crises. The work that builds on the research being honored this year makes society far more prepared to tackle this problem. This lessens the possibility that short-term financial crises will turn into long-term depressions with serious societal repercussions, which is, to everyone's greatest benefit. References:

0 Comments

Leave a Reply. |

Send your articles to: |