|

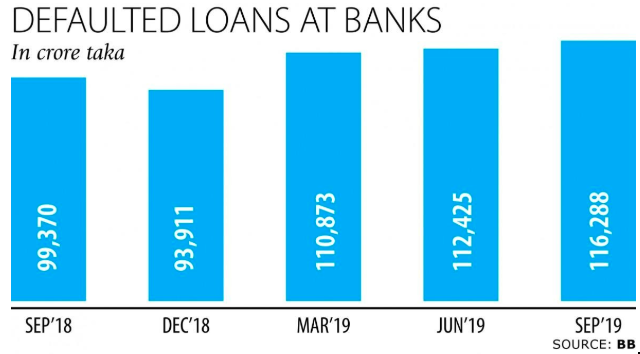

Kazi Aiman Udoy The banking sector plays a crucial role in the economy, mobilizing and channeling savings for productive investment. The better it does so, the better the economy will perform in the long-run through more productive economic activities and diminished financial risk. The role is even more pronounced in developing countries like Bangladesh, where a mature capital market is needed and the banks are the main source of long-term finance. A proper banking system guarantees appropriate use and proper allocation of resources. Easier access to capital by individuals and firms is required for undertaking various social and infrastructural projects, generating jobs, and accelerating productivity. The progress of the banking sector is a precondition for economic enhancement because of its important task of raising capital, savings and investments, as well as development in agriculture, industry and trade, and services. Extreme amounts of non-performing loans (NPL) in the banking sector is the predominant frailty of the Bangladesh economy. When a loan is sanctioned, it includes a repayment schedule comprising the principal and interest amounts. According to Bangladesh Bank regulations, a loan becomes non-performing when the borrower fails to pay the scheduled principal and interest amounts for more than 90 days. If the proportion of NPL increases, it diminishes the ability of banks to sanction further loans, their capability to repay the depositors, and their capacity to gain profit. Continued increase in the volume of NPL may lead to liquidity crisis in the overall banking sector and even crash of banks. Till June 2019 the amount of NPL in our banking sector stood at Tk 112,425 crore which is 19.71 percent higher than the NPL amount at the end of December 2018. The increase in NPL is, undoubtedly a threat to the financial health of our nation and we are in need of an effective remedy to this problem. There are many causes involved in the rise of non-performing loans in this sector. Firstly, political affiliation is one of the main reasons why defaulted loans are increasing. Political parties always try to secure loans for their favored persons. Over the past few years, through political influence many high officials have been appointed in the state-owned banks and their misconduct put the banking sector in jeopardy by unethically giving loans to devious customers. Lots of banks were established on political grounds. As a result, some third-generation banks were knotted in massive loans resulting in significant damage to the banking sector. Another important factor behind the rise of NPLs is the absence of good governance. In the process of reschedule payment of borrowed amounts, big loan defaulters are having multiple facilities. This problem is increasing day by day due to the absence of good governance. Application of good governance—accountability, transparency and rule of law—can bring the banking sector to the right track. Adverse selection is one of the causes behind the high volume of NPLs in Bangladesh. The wrong borrowers are being selected and wrong activities are being funded by the Financial Institutions (FIs). So, the question is what leads to such adverse selection? A straight-forward summary response to that would be - poor lending practices of the FIs. Usually the FIs do not have any appropriate research or business intelligence units to gather, monitor and analyze business information to assess the exact potential of diverse businesses under changing local and global economic and policy environments. Also these institutions have very little effort to find promising entrepreneurs, especially new ones. Available attempts like “Know your customer (KYC)” screening to determine the characteristics of the entrepreneur are often inadequate. For instance, information is collected on the credit status of the borrower from the Credit Information Bureau (CIB) and an unclassified status is considered satisfactory. But the number of times the borrower may have rescheduled the loan or created forced loan in the past is questionable. The Bandwagon effect is influencing the loan portfolio of the financial institutions. Enterprises are trying to be set up by many borrowers with institutional finance influenced by the success of others in particular types of activities. Previously it happened in the case of power loom, readymade garments, ship-breaking, cement etc. and lately such a craze is observed in setting up automated rice mills, brickfields, and hotels and holiday resorts. In the absence of appropriate assessment of the main factors of success in these activities, FIs generally get carried away by the enthusiasm of the potential borrowers based on others’ success stories. Financial institutions run the risk of making adverse choices to the extent that size of operation, market saturation, location, varying entrepreneurial traits and a host of other factors may have bearings on the outcome of the investment. A poor appraisal of the credit proposal in the lending process is the second difficulty. Problems may arise due to faulty estimation of the optimum credit need when the activity (for investment) and the borrower are selected properly, which often leads to over-financing, creating scopes for fund diversion, over-invoicing and even money-laundering. Problems happen at the other end as well. In many cases the size and duration of loan is short and puts the borrower into severe cash flow problems for compounding high interest rate particularly. Faulty assessment of collateral, resulting in under-coverage of the loan or acceptance of collateral of dubious quality is another side of deficient appraisal. When there is collusion between the lender and the borrower or undue pressures are exerted by influential borrowers, these instances of system failures and lack of due diligence get compounded. In a few extreme cases of collusion or pressure from influential quarters, funds are siphoned off against little or no collateral or against false documents with the intention of money-laundering or diversion of funds to unauthorised uses. A true entrepreneur with a well-designed credit proposal is not likely to chaos with lenders as payoffs affiliated in such chaos will not be worthwhile for the borrower financially. Conversely , a big amount of overenthusiastic borrowers tend to over-design their credit proposals either in collusion with lenders or through support from influential quarters, swayed by the bandwagon effect. Adverse selection becomes a more likely outcome if credit proposals with such flawed design dominate the choice set faced by the financial institutions. Implementation bottlenecks further increase the menace of NPLs. The most alleged implementation snag seems to be the delay in fund disbursement and the corruption associated with it. Other than these aspects of poor lending practices, many genuine cases of business failures, which occur due to personal mishaps, accidents, adverse policy changes, market failures etc. also contribute towards creation of default loans.  Causes of NPL from the Banks’ side:

Causes of NPL from Clients’ side:

But what does the picture of defaulted loan recovery look like? The recovery picture does not appear to be very satisfying either. Recovery steps are generally frustrated by weak and lengthy legal proceedings, in the cases where the loan is well covered by sufficient collateral. During this time the outstanding debt continues to rise, overshooting the value of the collateral at the end. Through the legal procedures, the loan defaulters not only manage to get court orders to strike out their names from the CIB classified list but also get legal proceedings against them stayed, which provides them the opportunity to indulge in further borrowing. The financial institutions are on even weaker grounds to pursue recovery, in the cases where the loan is not properly covered by collateral. Where loan default involves gross irregularities, criminal proceedings are initiated against the offenders who often land in jails. But then the loan recovery process gets completely thrown out of line. The assets are often lost and any hope of the bank recovering a significant amount of the loan disappears as the banks cannot take custody of the assets of the defaulter until the criminal cases are disposed of. An absolute instance is the Hall-Mark case, where one accused died in jail and others are still behind bars, but the prospect of bank recovering the loan is almost zero. So, how does one get out of this messy NPL situation? What is the remedy? We know, “prevention is better than cure”. Firstly it has to be ensured that no new loans get classified. To make this happen, one needs to fortify lending discipline in the FIs. This will involve intervention at four levels: First, with strong and self-reliant internal control and compliance (ICC), the FIs must guarantee appropriate KYC and due diligence to satisfactorily assess a loan proposal and flawlessly settle market potential, value of the collateral and optimum credit needs. Second, the management should satisfactorily resolve all issues flagged by the ICC. Third, on the basis of strict objective criteria the selection and appointment of board members should be done and there should be a mechanism in place to monitor the performance of the board members. Fourth, the supervisory capability of the Bangladesh Bank needs to be strengthened. Necessary legal reforms to strengthen and expedite the legal process should be undertaken immediately for the improvements on the recovery front. Two measures can bring about important instant enhancements in the situation: A dedicated bench should be set up at the high court to dispose of loan-related writ cases and loan defaulters should be required to pay a certain percentage of their outstanding debt before they seek stay order on legal proceedings against them. For NPL resolution mechanism, Effective Bankruptcy Act and Asset Management Company should be put in place as an alternative, particularly to deal with default cases under-covered by collateral and those involving influential borrowers. Finally, the existing rescheduling facility needs to be made more accommodative, for a large proportion of cases, where the default is due to genuine business failure or fund disbursement delays by the bank. References:

https://www.thedailystar.net/business/news/npl-sources-malaise-and-possible-remedies-1840492 https://www.adb.org/sites/default/files/publication/533471/adb-brief-116-managing-npls-bangladesh.pdf https://www.thedailystar.net/opinion/economics/news/the-economic-consequence-non-performing-loans-1797394 https://www.bb.org.bd/pub/research/sp_research_work/srw1702.pdf

3 Comments

1/31/2023 04:12:51 pm

Reply

5/26/2023 07:14:02 pm

Thanks for your post.

Reply

5/30/2023 12:58:04 am

Thanks for your post.

Reply

Leave a Reply. |

Send your articles to: |