ECONOMICS STUDY CENTER, UNIVERSITY OF DHAKA

|

Tanjim-Ul-Islam, Shudipto Ahmed, Khandakar Iffah, Namira Shameem Crypto Mania is Coming to an End Tanjim-Ul-Islam Bitcoin has been an enigma for a while. Last year, prices started skyrocketing and then fell. Currently, price level stands at one-third of its peak price. Large financial institutions, including Barclays Bank, is trying to make sense of this situation. Barclay’s “Equity Gilt Study 2018” describes crypto-technology as “a solution still seeking a problem”.  It identifies four challenges in particular. They are:

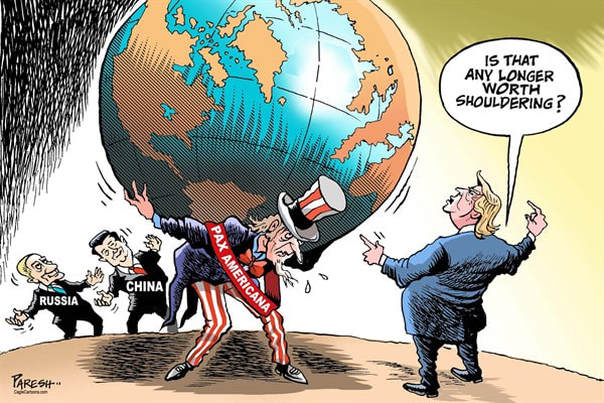

According to surveys, 8% of Americans who hold bitcoin do so for purchases or payments which in turn means that bitcoins are mainly dependent on the speculative demand. This means that bitcoin mania is essentially a bubble. This suggests that the long-term outlook for the value of crypto-currencies is bleak. Many impulsive investors will face heavy losses. Some will be keen to sell their crypto-assets. But new buyers will be harder to tempt now that crypto-currencies no longer look like a one-way bet. As the crypto mania ends, perhaps the block-chain can be utilized for another purpose such as recording property transactions.  Germany's China Problem Shudipto Ahmed For more than a decade, Germany has been the growth locomotive of Europe, its economy weathering global financial turmoil, the eurozone debt crisis and a record influx of refugees. That resilience was based on two key drivers: 1) Innovative German firms that produced high-end manufactured goods in high demand by fast-growing economies and 2) Rules-based competitive global trading system. China has been crucial on both fronts. German companies were among the first in the West to set up shop in China, thus giving them a competitive edge over others. At that time, there was little to no competition in the Chinese market for the kind of high-end goods these companies made. Companies, having realized the scope of the profit that could be made, invested heavily in China. But as an official at the powerful Federation of German Industries said, “there is a huge concern for what lies ahead”. A few reasons why: 1) Competition in this high-end goods market has radically increased with equally innovative Chinese companies rising in unprecedented numbers. 2) The laissez-faire role that the Chinese state played in the market is changing. This broader shift includes but is not limited to increasing pressure to have Communist party officials on the joint venture boards of foreign companies and the introduction of a new cybersecurity law that significantly undermines the confidentiality of companies, thus, making it difficult for German companies to maintain their competitive edge in the Chinese market. However, companies have become so dependent on the Chinese market that Germany has been unable to confront China on many of these discrepancies for fear of economic backlash as seen against Donald Trump’s administration. This has thrown a wrench in the decades-long German approach to China which was to affect change through trade. With many foreign firms signaling their departure from the Chinese market in the upcoming years and the increasing boldness of China with regards to translating their economic might into political clout, Germany is also likely to assume tougher stance in the coming days, though their ability to do so is contingent upon bridging the growing division between EU member states and the current administration of the US.  China posts strong economic growth despite trade concerns Khandakar Iffah China experienced an economic growth of 6.8% following the first quarter due to strong consumer demand and increased property investment. However, all these factors may face moderations in coming months. Trade disputes between China and USA, although not expected to break into a trade war, might lead to the country taking measures such as the 50 billion dollar tariff. Trade disputes hampering China’s exports were expected to bring growth rate down. Net exports were a drag to the GDP but rising consumption and investment canceled out the effects. Consumption accounted for 80% of GDF in the first quarter. China’s investment is growing rapidly but it is expected to slow down. Though the real estate investment accelerated to 10.4 percent in the quarter - the fastest pace in three years, the January-March fixed-asset investment growth slowed to 7.5 percent, below expectations and 7.9 percent in January-February. Private sector investment, however, rose from 8.1% to 8.9% during the same time. This growth has also meant that the country has lower financial pressure and so they can fund for the reduction of pollution in the economy without hampering growth. Despite a more upbeat first quarter than expected, analysts still predict China’s economic growth will slow down to 6.5 % this year, with the ongoing regulatory crackdown and U.S. trade dispute seen as key risks.  Will protectionism destroy current world trade system? Namira Shameem With countries imposing stringent trade barriers upon rival nations, Christine Lagarde, Managing Director of the International Monetary Fund (IMF) has cautioned governments and policymakers to desist the use of protectionism to prevent the current global trade system from crumbling. Despite a trade deficit of $375bn with China, Donald Trump threatened $150bn import tariffs on Chinese goods. Chinese president Xi Jinping threatened to retaliate, leading to increasing trade tensions between US and China. In light of these events, Lagarde has warned that further escalation of protectionist measures could disrupt the current economic growth momentum and put a strain on the consumers of low-priced imports resulting in what she says “inexcusable collective policy failure”. In order to lower trade barriers and resolve trade disputes without resorting to “exceptional measures”, policymakers must cooperate and work constructively. Altering domestic policies to regain trade balance and using dialogue to dissolve disagreements via international forums are two steps she strongly suggests nations such as the US take in order to reform. Trade imbalances usually stem from the fact that the country’s expenditure exceeds its income. Using fiscal means to deal with global trade imbalance is crucial. For example, lowering public spending and raising revenue could help lower future fiscal deficits and steer public debt in a sustainable direction. Lagarde's advice may secure the economic upswing and promote further growth. However, it is up to the nations themselves to steer clear of protectionist measures in order to sustain this growth.

1 Comment

12/15/2022 12:01:12 pm

Thank you for the wonderful content. Continue to post!

Reply

Leave a Reply. |

Send your articles to: |