ECONOMICS STUDY CENTER, UNIVERSITY OF DHAKA

|

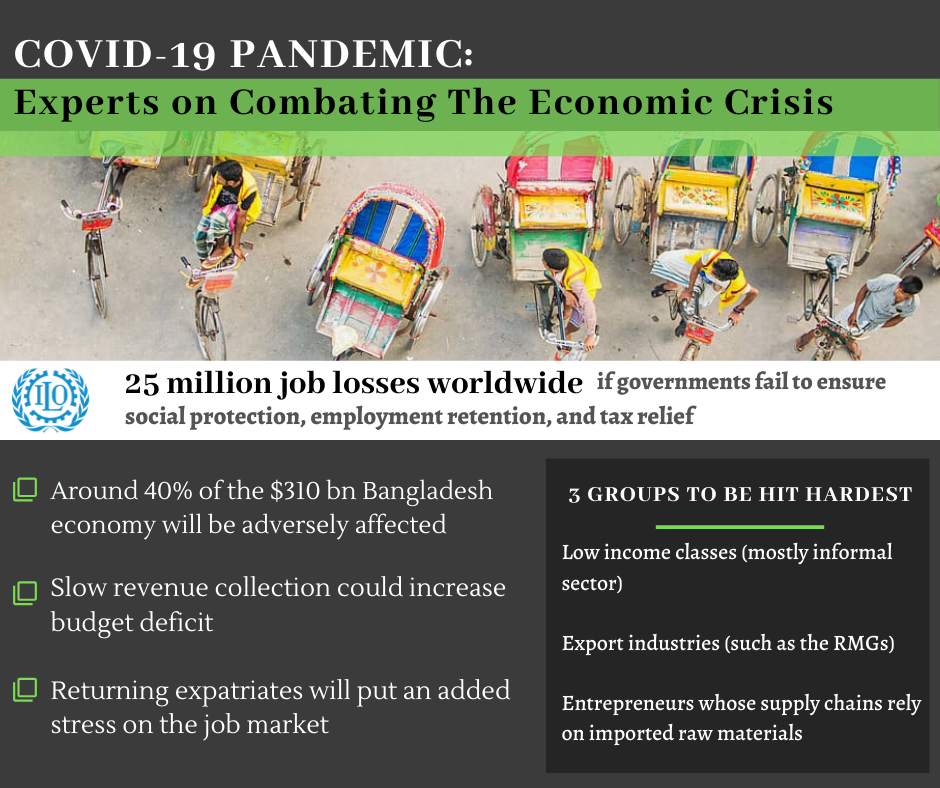

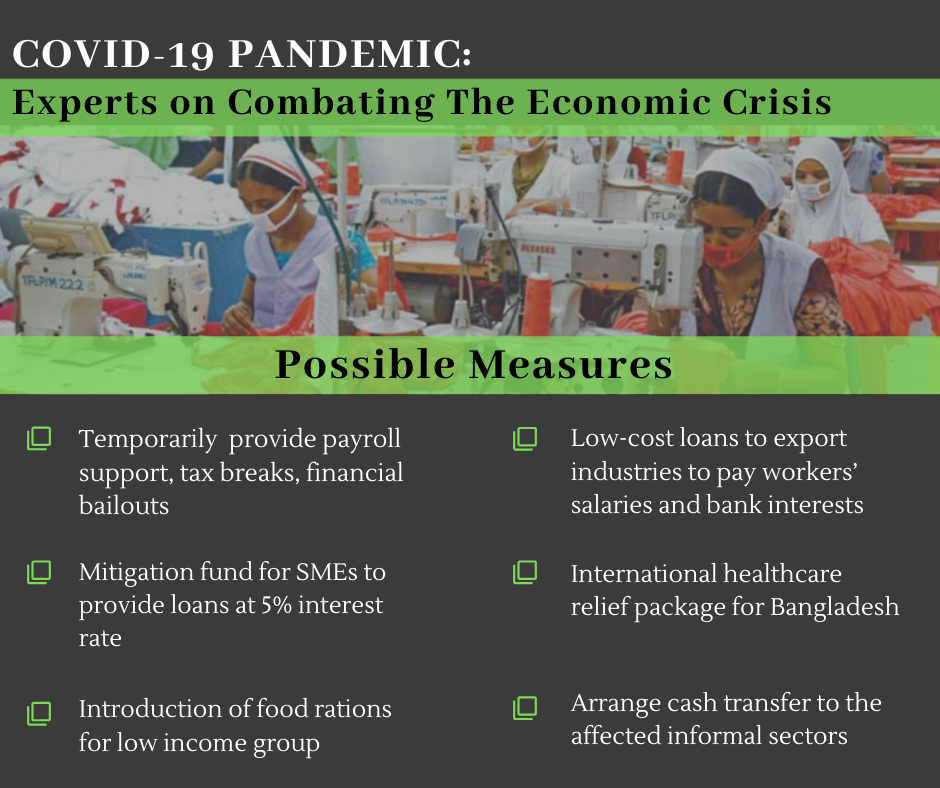

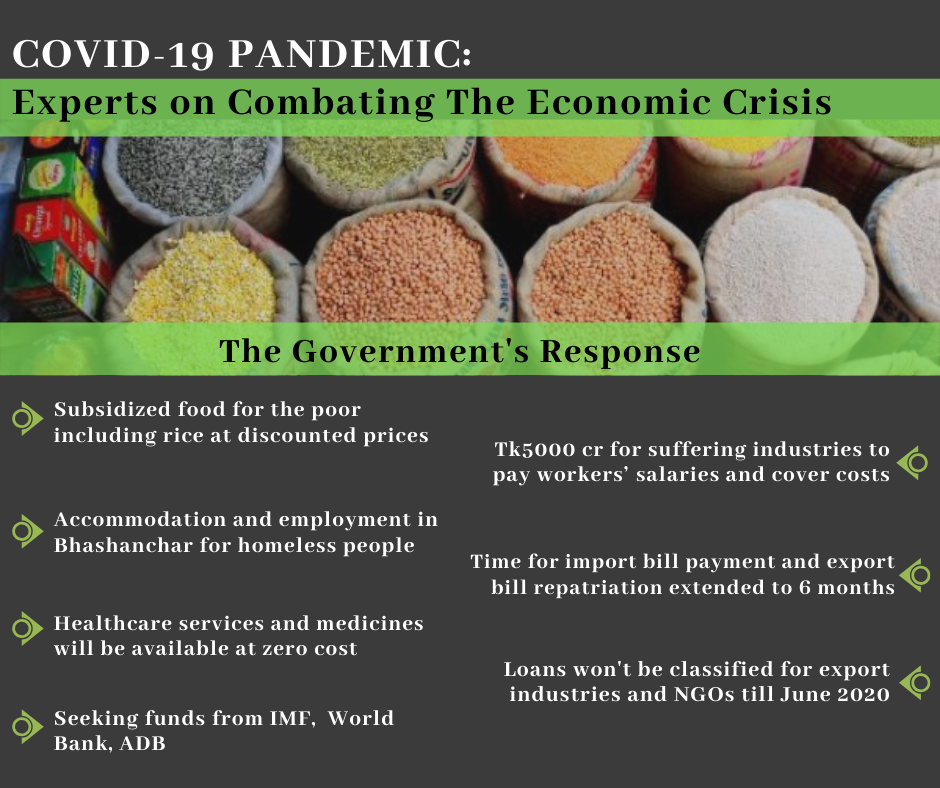

by ESC Blog Editorial Panel Much has been said about the novel Coronavirus - its origin from Wuhan, China to its rapid spread across 196 countries resulting in widespread panic and emergency measures. As the world continues to hope for cures to this pandemic, its consequences will be far-reaching and its aftermath, dire. And even when nations are finally Corona-free, another challenge will overshadow our victory over the virus. The state of the economy will be left in shambles, with major industries losing business and struggling to survive. The majority of the poor population - day laborers, rickshaw pullers or garments and factory workers - left unemployed. These vulnerable groups, with their meager incomes cut off, are most at risk in case of country-wide lockdowns. In an attempt to discover the possible measures that could be taken or are already in place by the government, Economics Study Center compiled the various responses from experts, think tanks and government officials. What the experts are saying: International Labor Organization estimated the loss of upto 25 million jobs worldwide if governments fail to ensure social protection, employment retention through short-time work or paid leave, and tax relief for micro, small and medium-sized enterprises. In the context of Bangladesh, economists and policymakers shared their estimations and solutions to tackle the crisis. According to Dr Zahid Hussain, former Lead Economist, World Bank, at least 2% of Bangladesh’s GDP will be required to provide financial assistance to keep both the formal and informal sectors afloat. Partnering with para-state and non-governmental organisations and using digital financial services for unconditional cash transfers will prevent vulnerable groups from falling into poverty. Bearing in mind the limitation of resources, other measures include temporarily providing payroll support, tax breaks and financial bailouts. Mustafa K Mujeri, Executive Director Institute for Inclusive Finance and Development (InM), expressed concern over losses that are being incurred by the private sector. He believes that the incentives required by this sector could further increase the budget deficit caused by slow revenue collection. In a virtual media briefing, the Independent Review of Bangladesh's Development (IBRD) team of the Centre for Policy Dialogue (CPD) shared their own projections and recommendations. They noted that returning expatriates will put an added stress on the job market. To ensure workers’ jobs are retained, export-oriented industries such as RMG will require low-cost loans to pay workers’ salaries and bank interests. A mitigation fund for COVID-19 affected SMEs could be set up by the government to provide loans at 5% interest rate. Policy rates can be lowered, and the government can buy treasury bills to provide additional money to the banking sector, which is already in a liquidity crisis. Service-oriented sectors such as travel and tourism could be provided a minimum support to retain employees, cover regular expenses and support facilities for contractual or seasonal workers. For low income groups who survive on daily wages, CPD suggested the introduction of food rations. Various personalities from CPD also shared their views on the matter and the route the government can take to address the issue at hand. The global pandemic will adversely affect around 40% of the $310 bn Bangladesh economy, said Professor Mustafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue (CPD). He also added that in spite of the recent developmental progress, Bangladesh lacks adequate shock absorption capacity. Dr Fahmida Khatun, Executive Director, Centre for Policy Dialogue (CPD) stressed the need for an international healthcare relief package for Bangladesh to deal with the crisis. She also said "Now the government has to work on how it can expand social safety net schemes and arrange cash transfer to the affected informal sectors." Dr Khandker Golam Moazzem, industrial economist and Research Director, CPD suggested that essentials should be provided at subsidised rates to people working in the service sector and the informal sector. Dr Hossain Zillur, Executive Chairman, Power and Participation Research Centre, and Chairperson, BRAC, identified the three groups which are to be hit the hardest by the upcoming economic crisis: export industries (such as the RMGs) that depend on foreign markets, entrepreneurs whose supply chains rely entirely on imported raw materials or machinery, and finally the low and lower-middle income classes. He urges the government to address the needs of the urban poor, majority of whom are involved in informal activities. While comparing the situation with the 2008 global financial crisis, the former adviser to the caretaker government said that unless the outbreak ends within the next two months, our economy will be in a similar, if not worse, condition. He calls upon economists and organized institutions to come forward and initiate discussions with all stakeholders instead of relying completely on the government. MSMEs mainly produce for the domestic market, hence their income depends largely on domestic demand. Since the demand for various industries have decreased during this time of crisis, these firms can face some major difficulties, Dr Nazneen Ahmed, Senior Research Fellow, BIDS opined. She further emphasized the need to be considerate when deciding the debt repayment or refinancing schemes of MSME entrepreneurs. A few things to consider would be extending the repayment period for creditors, setting up a fund from which low interest, risk-averse loans can be provided to MSMEs. We have to call upon various organizations so that they do not let off workers to sustain demand. Emergency consumption loans can be arranged at low interest. We had been suggesting that the government eliminate consumption-lending in the implementation of 5 percent bank loans. However, under the current circumstances, it would be reasonable to provide short-term consumption loans at a small interest. Overall, the key recommendation remains to expand social safety net schemes. Reiterated by many experts are suggestions to provide temporary tax reliefs, payroll support, more optimised digital services for cash transfer, low or no interest loans for affected businesses and programmes to support low income groups. What the government is doing: The Government of Bangladesh has been criticised by many for their slow-response rate and inadequate disclosure of information in a timely manner to avert the crisis. However, in a press briefing on 23rd March, the government announced a few measures it will be taking to ensure that the situation is contained. In order to slow the spread of the virus, the government declared all public and private offices closed for ten days starting from March 26 except those involved in emergency services such as law enforcement and hospitals. However, banks will still be functioning, albeit in a limited manner. Even then, this poses risk to bank employees. Furthermore, ongoing physical transactions of money remains a major source of spread. Many families have seen this closure as an opportunity to return home to other parts of the country. Since inter-district travel has not ceased till 26th March, they are leaving cities and thereby increasing the risk of spreading the virus. The finance ministry assured subsidized food for the urban poor which includes rice at discounted prices (5 BDT per kg) through the open market sale in collaboration with the army. However in her address to the nation on 25th March, Prime Minister Sheikh Hasina added that rice will be sold at Tk10 per kg. The 17.51 lakh tonnes of rice and wheat available in stock, as recorded on the food ministry website, are to be utilized in this programme. The government has pledged to pay the salaries and wages in case factories are shut down, increase the allowance under the social safety net programmes, and even generate employment for those who lose their jobs due the pandemic. For this, a fund of Tk5000 crore has been set up for suffering industries to pay workers’ salaries and cover daily costs. No-interest loans and extension of repayment periods are also measures the government promised to take. In case of nonpayment of bank loans by export-oriented industries and NGOs, loans will not be classified till June 2020. The time for import bill payment has been extended from 2 months to 6 months while the time for repatriation of export proceeds has been extended to 6 months from 4 months. As has been recommended by experts and think-tanks, the Bangladesh government decided to avail budgetary support from various development partners. It is expecting to receive $750 million from the International Monetary Fund (IMF), $100 million from the World Bank, $500 million from Asian Development Bank (ADB), and $50 million in grants from Jeddah-based Islamic Development Bank. At the press briefing, Cabinet Secretary Khandker Anwarul Islam announced that if anyone struggles to maintain their regular livelihood in the cities and wishes to return to their respective villages, they will be assisted by the government's “Ghore Fera Kormoshuchi” (Returning Home) programs. Moreover, one lakh landless and homeless people will be given accommodation and employment in Bhashanchar, an island in Noakhali initially built to accommodate Rohingya refugees. The government will assist anyone who wishes to move there. However, some questions remain unanswered: Will the state provide full support in terms of food? And/or for how long can they take shelter in these areas? The ceiling for cash transfer using mobile banking services has also been raised. Programmes such as Vulnerable Group Development (VGD) will continue while healthcare services and medicines will be available at no cost. But which places will be offering free healthcare, for which groups and how these groups could be differentiated raises more concerns. Much of the recommendations suggested by experts have thus far been addressed by the government. Yet, some skepticism remains as to how many of these will actually come to fruition. In the past, the government had made many such promises to the Rana Plaza victims, but even seven years later, not all have been fulfilled. Whatever the government chooses to do, it must act now, before it is too late. In a world where even developed countries are ill-equipped to deal with the crisis, being a developing one, the challenges we face will be much greater. COVID-19 has put a halt to economies worldwide, but for Bangladesh it stands as a hindrance in the streak of the fast-paced growth we have shown over the past years. When all this is over, how will Bangladesh recover? Will it lead to further income divergence in comparison with other countries? Or can the government make adequate use and proper distribution of its limited resources to ameliorate the adverse effects of this deadly pandemic. References:

0 Comments

Leave a Reply. |

Send your articles to: |