ECONOMICS STUDY CENTER, UNIVERSITY OF DHAKA

|

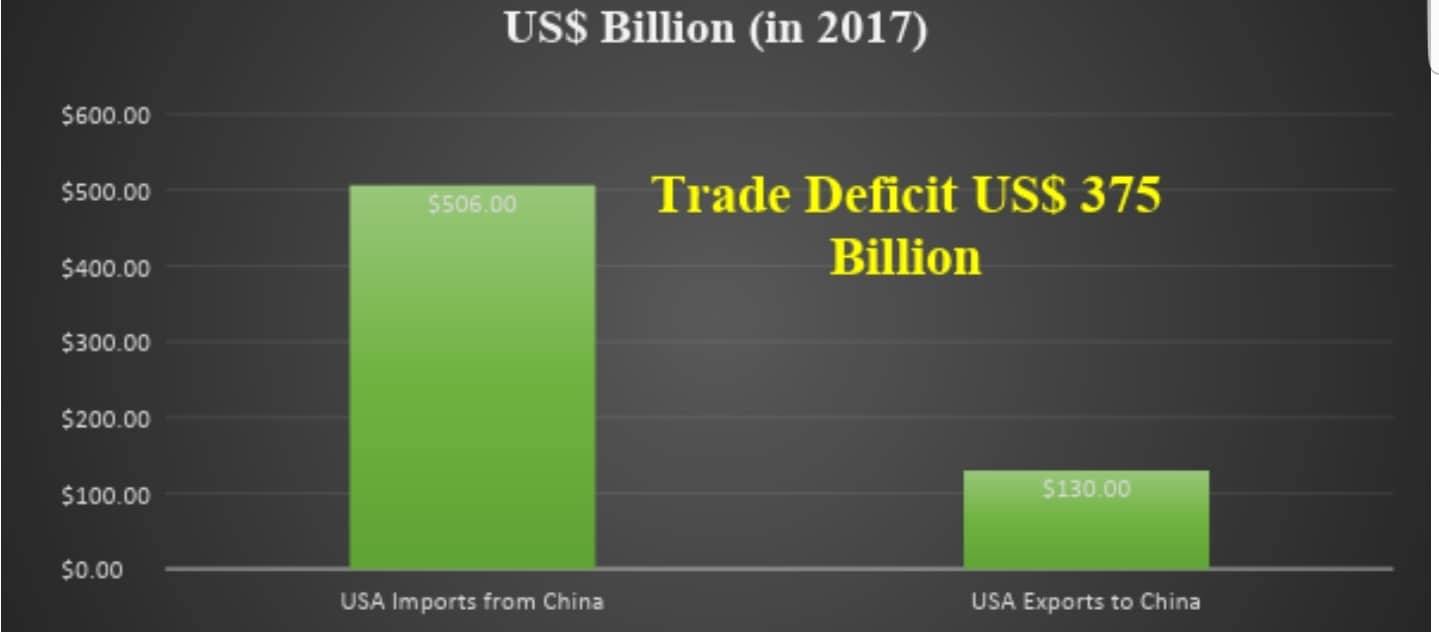

Sazeda Akter The trade war between the world's two biggest trading partners the US and China has now become a major attraction for everyone. After the US election, the Trump administration has taken different economic and administrative policies i.e. trade protectionism, immigration reduction, individual and corporate tax reform etc. As a part of the protectionist policy and saving itself from an egregious trade deficit of US$375 billion (in 2017) with China, U.S has taken a new tariff policy by imposing 25% tariff on US$34 billion worth of Chinese goods on 6 July 2018. The adjudication was taken on the cornerstone that the trade between the US and China is partial and one-legged. Moreover, the US accused China of plundering their tech, Intellectual Property rights (IP), influencing the labor market and major US-companies.  The export-import figure of the USA with China shows a trade deficit of US$ 375 billion in 2017 where it was US$ 347 billion in 2016, an increase of US$ 28.2 billion or 8% of the deficit in commerce. The assessment of tariff first started with some products like solar panel (30%), washing machine (20%) and now other products like steel, aluminum, aircraft parts, TV, battery, medical devices, caviar, satellite and various weapons, etc. In retaliation, China imposed a tariff on 128 items of American goods including aluminum, airplane, car, pork, soybeans (25%), grapes, apples, nuts (15%) etc. On July 9, US threatened to impose an excessive tariff of 10% on $200 billion equivalent of chinese accessories. In response, China threatened to impose tariff on $60 billion equivalent of american goods. The trade war involves not only China but also Mexico, Canada, EU etc. If this distributive bargaining (a bargaining strategy in which one party wins only at the expense of other) or the beggar thy neighbor policy of Trump administration continues, it will lead the world economy towards a recession. The ripple effects (an action that has an effect over several other entities) of this trade war are an increase in the price of the day to day goods (shoes, garment, electronic), decline in sales, diminution in the stock prices, disruption in the global supply chain. Also, while a number of factories might enjoy an employment growth, others will have to lay off some of their existing workers. China which is the buyer of a third of the entire soybean crops from the USA has canceled their orders and tripled their imports of Soybean from Russia, which leaves the American farmers worse off. As a consequence, Russia is getting hard currency. Moreover, this trade war has exhorted many Brazilian farmers to dump sugar for soybean in an expectation of greater profit margin. The environmental economists also showed their concern on the imposition of tariff on the solar panel as that could hamper the achievement of SDG. As we are on the verge of global climate change, a tariff on such eco-friendly tech could increase the threat of global warming. The metal tariff has made importation of steel and aluminum made products difficult, driving down the consumption of foreign goods and boosting up the demand of the domestic market.  The Ford and Boeing's production cost has now increased which is threatening their global competitiveness. As opposed to that, a tariff of 25% on the importation of washing machine has benefited some domestic producers i.e. Whirlpool corporation. The overall effect of this trade war is simply causing a loss of consumer purchasing power where consumers have to pay more for domestic products (made in America). Consumer's liberty is being manipulated, which is not acceptable on any grounds. Again, this trade war could cause many Chinese factories to relocate to other developing countries of South Asia and Southeast Asia where the tariff burden is low. But which country would get this opportunity of attracting more Chinese FDI depends on domestic environment, infrastructural constraints, political stability of that country. The trade war has taken a new turn as China and other European countries are being accused of manipulating their currencies by the USA. China maintains a fixed or pegged exchanged rate against US dollar through buying and selling currencies with the US treasury. The People’s Bank of China has now set the dollar-yuan exchange rate at 6.77 yuan per dollar, pushing the currency by 0.9% lower, a voluminous devaluation. On the other hand, the US's interest rate is at its high, making the dollar more expensive and desirable as it signals a higher expected rate of return on dollar diieposit. The depreciation of the Chinese currency against the dollar has made export cheaper for China and competition against other manufacturers easier, which can now overlap the effect of the US tariff on China. Conversely, this devaluation has made imports costly for China which is perilous and could destabilize the country's trade balance and financial system. The devaluation now makes speculation possible and would encourage Chinese exporters to keep their currencies in the dollar by selling yuan for the dollar. The depreciation could also create pressure on other Asian countries as they would have to devaluate their currencies in fear of losing the market share against China. But it is not good and could cause a world recession by engaging other countries in a currency war. The US can counter China’s devaluation scheme by forming a strong alliance with other Asian countries and taking proper actions in a sensible manner. The trade war should be stopped by both the US and China by co-operating with the international community, building alliances and a mutually benefiting trade agreement which can appease the deficit problem of both countries. Otherwise, it will lead to a currency war with an active involvement of many developed as well as developing countries. We hope the WTO will take a leading role here to solve this conflict between these two countries as they are doing nothing but taxing their own people.

1 Comment

|

Send your articles to: |