|

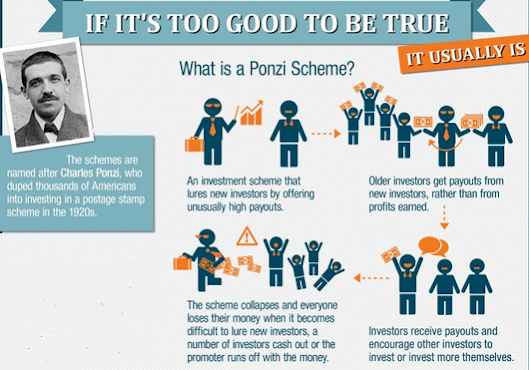

Md Hasin Israq, Hasibul Hasan Cover Design: Farha Tasneem Introduction The occasional occurrence of financial scandals and scams is a fact of life in business and investing. Many of these scandals have been brought on by the excessive greed of a few individuals, whose actions had devastating repercussions that took down whole businesses and impacted millions of people. In this blog, we shall learn about seven such cases when persons or businesses first accumulated wealth by deceit but were eventually exposed. Great Ponzi Scheme Charles Ponzi inspired the name of the Ponzi scheme. Ponzi devised a scheme to exchange worldwide reply coupons (IRC in short) in 1919. These coupons can be used to purchase postage stamps. He thought it was possible to purchase IRCs at a discount rate in Europe and then swap them at face value in America. Arbitrage was the method, and it wasn't even forbidden. He initially went to friends and described the technique to them; some of them decided to invest because of the fantastic interest rate. He assured them that they would get 50% profit in 45 days. He also made returns. Ponzi used the funds obtained from the more recent investors to repay the primary investors. The plan continued longer as almost everyone reinvested their money. However, he had not disclosed the additional issues to these investors. First of all, he lacked a network of agents who were collecting IRCs. Second, even if he did, it would be extremely expensive to get them to Ponzi in the United States, which might be enough to wipe out the profit. A third issue also existed. The postal service notified him that they would only exchange the IRCs for stamps and not for cash. This implied that there would also be an issue with selling the stamps. He was required to pay $2 million within two days when the Boston Post later published an investigation on this scam. The collapse of Ponzi followed this. His primary bank account was frozen and there were five charges against him. He was taken to prison. However, this con had such an impact that it transformed any kind of pyramid scheme into a Ponzi scheme. Enron Scandal The Enron scandal was an accounting scandal involving Enron Corporation. At the time of its collapse, it was the largest corporate bankruptcy with $63.4 billion worth of assets in US history until the WorldCom scandal the following year. Enron was founded in 1985 and quickly became the largest seller of natural gas in North America. By 1992, the company had started diversifying its strategy under the leadership of newly appointed Jeffrey Skilling. Following the strategy of diversifying, the company invested heavily in the creation of an online trading platform named ‘Enron online’ and a high-speed broadband telecommunications network during the ‘Dot-com bubble’ in 1999. The good days soon came to an end as the bubble burst very quickly and the competition in the energy-trading business increased, which caused the profits to shrink rapidly. To hide their incompetence from the shareholders, company executives started showing misleading profits that were never achieved through an accounting practice called ‘mark-to-market accounting’. Billions of dollars of debt were also hidden by moving them to shell companies. These fraudulent practices made Enron look stable. However, the truth started to reveal itself very soon when Bethany Maclean’s article on Enron in The Fortune magazine asked how Enron could maintain its high stock value on 05 March 2001. Gradually, more such reports about some concerning practices at Enron accountings prompted the US Senate to launch an investigation against Enron. As the details of frauds emerged, Enron went into free fall and on December 02, 2001, Enron filed for chapter 11 bankruptcy protection. The Enron scandal took down its auditor, Arthur Andersen as well. Scam 1992: Harshad Mehta Scam Scam 1992(aka Harshad Mehta Scam) is the greatest stock market scam of India of all time. He had an excellent stock market understanding as a result of working in various organizations. Harshad and his brother founded Expand More Research and Asset Management in 1984 after 30 years of working for several business companies. In the interim, he was appointed BSE's broker. He had chosen Rf (Ready Forward Deal) as his tool in this con. When a bank needs money, it can borrow from another bank and use its government security bonds as collateral. And he independently raised this money for those banks, put it into the stock market, and then gave it back to them after making a profit. He also forged an RF receipt to accomplish this. Now coming to the stock market. Harshad manipulated the stock market with this money. For example, he increased the stock price of ACC from 200 to 9000 within a few months. Harshad made significant investments in the stock market, which raised share values and piqued curiosity among normal people. More money was invested, and as a result, the share price rose. When a company's stock was at its highest, Harshad used to sell all his shares and make a large profit.  Source: Quora Source: Quora Then, after providing a bogus receipt to the bank, he would withdraw the money. It went well until the bear run came into the share market. Due to the bear run share prices fell and Harshad Mehta made a lot of losses. At last, he was exposed in a Times of India piece on April 23, 1992. The entire banking system lost between 3,000 and 4,000 crores of rupees to this fraud. On November 9, 1992, he got arrested and he was facing 600 civil and 70 criminal lawsuits. WorldCom scandal MCI WorldCom is a scandal where senior officials at MCI WorldCom, including its founder and CEO Bernard Ebbers, organized a plot to conceal losses and inflate revenues from 1999 to 2002 in order to satisfy Wall Street's expectations. At the time, WorldCom committed the greatest accounting fraud in American history by overstating its assets by over 11 billion dollars. In 1983, Long Distance Discount Services, or LDDS, was established. Following a straightforward strategy known as "line cost," which involves renting out the infrastructure, such as cellphone towers and landline cables, from other businesses. Within the first few months of Ebbars taking over, income increased after incurring losses over the previous two challenging years. Ebbars immediately started employing a different strategy of purchasing or merging with other businesses in order to withstand the fierce competition in the industry. In the following ten years, Ebbars bought 30 businesses. When WorldCom combined with MCI in 1998, it underwent one of its major mergers. This $37 billion merger resulted in the company changing its name to MCI WorldCom. WorldCom's assets might benefit from this process of acquisition and merger by expanding quickly. However, following its failed $115 billion merger attempts with the Sprint Corporations, the business urgently required a means to demonstrate that its assets had increased. The company's CFO, Scott Sullivan, instructed his accounting team to employ dishonest accounting practices in a last-ditch effort. The fraud was principally carried out in two ways: 1. recording "line costs" on the balance sheet as capital expenditures rather than expenses, and 2. inflating revenues through false accounting entries from "corporate unallocated revenue accounts." Cynthia Cooper, an internal auditor, began the planned capital expenditure audit for that year a few months ahead of time after reading an article on WorldCom's misleading accounting practices in the "Fort Worth Weekly" in May 2002. Later estimates placed the fraud's value at $3.8 billion. At this point, the SEC was already investigating WorldCom for what could have been unlawful accounting practices. By the end of 2003, it was estimated that the company's total assets had been overstated by almost $11 billion. On July 21, 2002, WorldCom declared bankruptcy, making it the largest bankruptcy case in American history at the time. 1MDB Scandal The 1MDB scandal centered on 1MDB (One Malaysia Development Berhad), a strategic development firm in Malaysia. Najib Razak, the former prime minister of Malaysia, started this scandal in 2009, but it was only recently made public. A sovereign wealth fund, also known as a huge bowl of savings accounts, is a state-owned investment company. As a state-owned corporation, 1MDB was expected to provide funding for initiatives that would expand Malaysia's economy. To raise more than $8 billion in funds through bonds, the government enlisted the services of Goldman Sachs, a US-based financial bank. Goldman made $600 million in earnings during this affair, which is 10 times more than banks generally make from bond issuances. Despite being a state-owned corporation, Jho Low, a financier, is credited with coming up with this grand scheme to con the nation. The business used a variety of methods to launder money. For instance, the business would trade with dubious oil service firms like Petrosaudi, buy properties at inflated rates, transfer money to overseas businesses that didn't exist, etc. When Clare Rewcastle Brown, a British reporter, discovered emails containing dubious transactions between 1MDB and Petrosaudi, she published the information about the scandal for the first time. The word quickly spread throughout the entire world. At least six nations are looking into corruption connected to 1mdb. In the wake of the controversy, Najib lost the general election in 2018 and was subsequently charged with criminal breach of trust, money laundering, and abuse of authority. Meanwhile, the accused scheme's ringleader Jho Low was charged with money laundering. For its role in the affair, Goldman Sachs has consented to a $2.9 billion settlement. Theranos and Elizabeth Holmes Elizabeth Holmes, the youngest self-made female millionaire, was on top of the world in 2014 at the age of barely 30. She was a Stanford University dropout who started a $9 billion (£6.5 billion) enterprise that she claimed would revolutionize medical diagnosis. And she began to be referred to as the "new Steve Jobs." Theranos was that revolutionary enterprise, a privately held healthcare technology company. It performed a test known as the Edison test by using a "nanotainer," which allowed for fast detection of diseases like diabetes and cancer without the trouble of needles according to them. But by 2015, the tide had turned against Elizabeth Holmes and Theranos, and a year later, Holmes had been revealed to be a fraud. Her Edison test came out to be completely useless. The majority of test results used to be incorrect, and mostly they used to test on different machines to display proper findings. The Wall Street Journal published a series of articles alleging that the results were erroneous and that the company had conducted the majority of its testing on widely accessible equipment made by other manufacturers. The enterprise Elizabeth Holmes started had failed by 2018. In March of that year, Holmes reached a lawsuit settlement with financial regulators on allegations that she defrauded investors out of $700 million. Destiny Group Scandal (Bangladesh) A pyramid scam that existed in Bangladesh, Destiny was a "Multi-Level Marketing (MLM)" business that eventually expanded into sectors including print media, television media, real estate, etc. The Bangladesh Bank estimates that Destiny Group laundered over BDT 51.13 billion. Since its establishment in 2000, Destiny had generated TK 41.16 billion and has assets spread throughout 22 Bangladeshi regions. It sold 50 million trees to 1.7 million investors while only 5.3% of those existed. Over time, the organization also became active in Bangladesh's media industry and continued to have a significant influence on the administration of the nation. However, in early 2012, the group's abnormalities came to light after the central bank discovered that it had engaged in illicit banking. The Anti-Corruption Commission (ACC) filed two lawsuits against 53 Destiny officials on July 31, 2012. The Destiny officials stole BDT 4200 crore and transferred it to their personal accounts and the accounts of the 20 companies. One thing that is common in all these scams is the desire for early profit. This further took the investors to the door of scam schemes and indeed they lost a bulk amount of money. Moreover, it’s not only about money, but it also leads to defamation and the involved parties have to face other harsh consequences that come with it. We all know that we need investment, for the advancement of the economy. But before investing, we need a bit of vigilance; which can save us from the catastrophes mentioned. References: The Crime Magazine- The Great Ponzi Crime Magazine http://crimemagazine.com/great-ponzi CNBC TV- Harshad Mehta Scam Explained https://www.cnbctv18.com/market/scam-1992-harshad-mehta-scam-explained-7417101.htm Britannica- Enron Scandal https://www.britannica.com/event/Enron-scandal Investopedia- Thernos: A Fallen Unicorn https://www.investopedia.com/articles/investing/020116/theranos-fallen-unicorn.asp. The Daily Star- Money Laundering: Destiny https://www.thedailystar.net/country/money-laundering-destiny-md-50-others-indicted-1274770 The Guardian- WorldCom accounting scandal https://www.theguardian.com/business/2002/aug/09/corporatefraud.worldcom2 Goldman Sachs and the 1MDB Scandal https://corpgov.law.harvard.edu/2019/05/14/goldman-sachs-and-the-1mdb-scandal/

7 Comments

2/4/2023 12:11:26 am

Wow! Love this post! Happy I found such a nice post. Thanks for sharing!

Reply

2/12/2023 12:00:48 am

Worldwide Discreet and Legal Online Monitoring Services.

Reply

7/22/2023 06:50:14 pm

Reply

7/24/2023 03:00:45 pm

Are you looking to uncover the truth?

Reply

9/14/2023 06:31:13 pm

Thanks for your post.

Reply

5/20/2024 11:24:23 pm

Thanks for your post.

Reply

6/10/2024 01:14:09 am

Thanks for your post.

Reply

Leave a Reply. |

Send your articles to: |