ECONOMICS STUDY CENTER, UNIVERSITY OF DHAKA

|

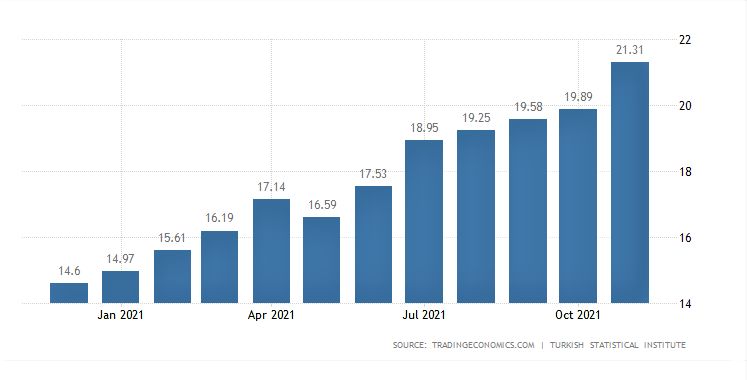

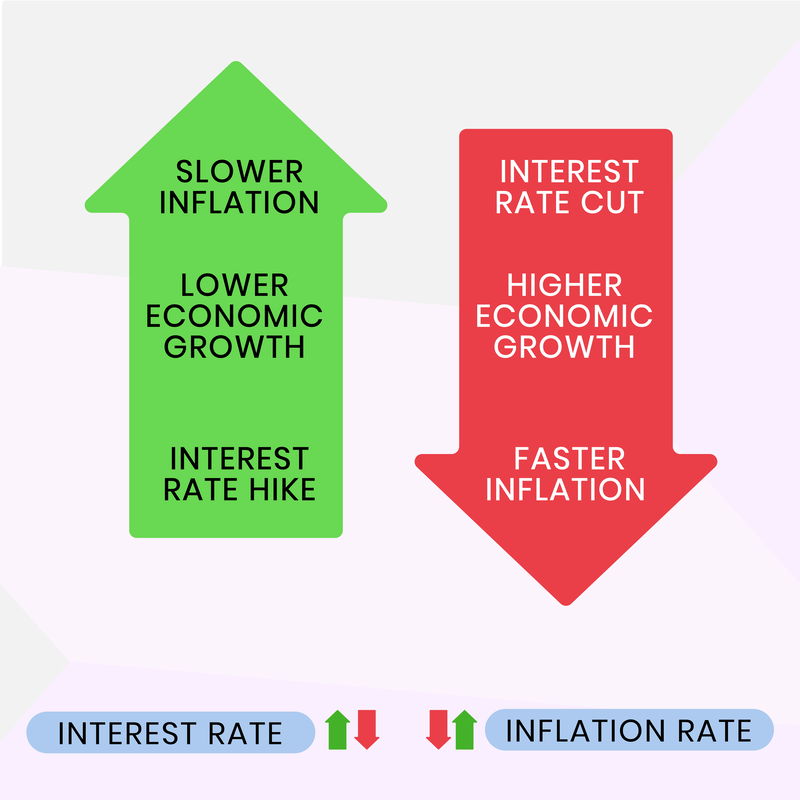

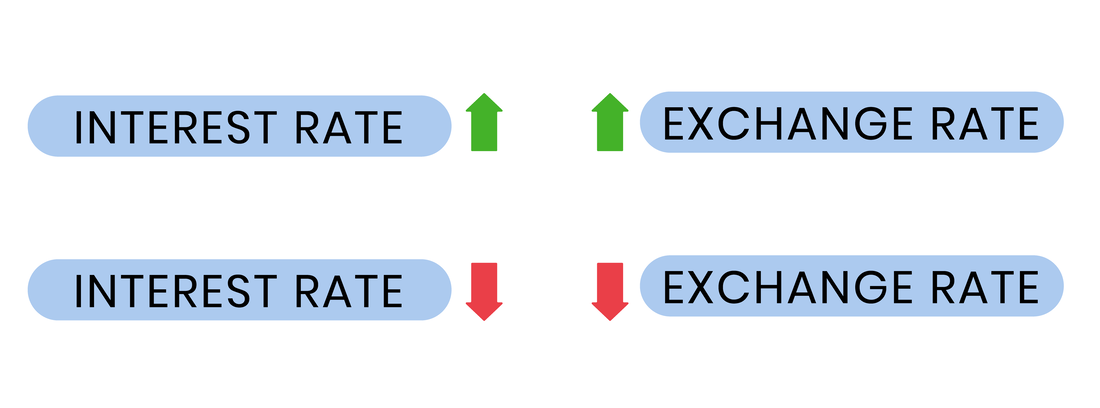

Abrar Ahammed Bhuiyan  Cover design: Abrar Ahammed Bhuiyan With the soaring world energy prices and the disbursement of stimulus packages in the previous year, countries are confronting relatively high inflation. But it is now critical for the citizens of Turkey as the country's core inflation is at 17.62%(Nov 2021). It all started when the central bank of Turkey cut its interest rate for the third successive month to 14% in November while most of the emerging market economies raised them. President Recep Tayyip Erdogan has pledged to keep the interest rate lower. Cutting the interest rate repeatedly has its consequences. The lower interest rate in the economy has been discouraging foreign investors, and the country has been facing a surging capital flight. In 2021, the lira has lost its value by 31%. Change in the consumer price index is 21.31% year-to-year as of November 2021. As the country is heavily dependent on imported goods, citizens became concerned as consumer goods are becoming more unaffordable due to the falling currency. In this article, we will try to know what are the variables that we should look into for analyzing the situation, why the interest rate is the most important tool when it comes to controlling the inflation and exchange rate, and why the decisions of the present Turkish government are not aligned with the classical view of economics. Two relations for the simplest perspective To understand how three variables of macroeconomics the interest rate, inflation, and exchange rate related to each other we can consider these two points- 1. Interest rate and inflation have a negative correlation. These two changes in the opposite direction. When the government raises the rate of interest, taking loans becomes relatively expensive, and it translates into less investment. Less investment means fewer jobs (more unemployment). So people now have lower income and lower spending. Lower spending results in lower aggregate demand for goods and services, which translates into a lower price level. When the price level goes down, inflation goes down (as inflation is the percentage change in the price level). The cycle involves investment, employment, demand, and inflation or the change in the price level. 2. Interest rate and exchange rate mostly have a positive correlation. These two go up and down simultaneously. When the interest rate is high, foreign investors are encouraged to invest in that country that requires more domestic currency. When demand for domestic currency is relatively high, it becomes more valuable and expensive. Thus, the exchange rate becomes relatively high. An expensive currency depresses exports and stimulates imports. This cycle involves exchange rate, export, and import. The solution and why the government will not avail it As Turkey is now experiencing a higher inflation rate that is still rising, it needs to increase the rate of interest. Though raising the interest rate can take inflation down, the process involves more unemployment. Keeping the upcoming election in mind, the present government is not willing to go down this way. Moreover, Turkey is now an import-oriented country, which means that the country depends heavily on imported goods. Under the New Economic Model of Turkey, the goal is to turn its economy into an export-oriented one. Turkey is not willing to increase the interest rate, as a higher rate of interest translates into a higher exchange rate that depresses export. “We’ve put aside the classical understanding of economics that keeps inflation under control with high-interest rates.” -Erdogan. However, the country is trying to control the rapid devaluation of its domestic currency by selling and pushing more dollars into the economy. They believe this operation will appease the situation that has been caused by not raising the rate of interest (the cure of uncontrollable inflation). Erdogan’s view and the War of Economic Independence In just over two years, President Erdogan has sacked three central bank governors and the majority of members of the rate-setting committee just to stick to the low rate policy. Under the New Economics Model, the government’s goal is to boost exports, employment, and investment by achieving a competitive currency with a lower exchange rate. President Recep Tayyip Erdogan believes that lowering interest rates will stimulate investment and will help in job creation and economic growth. He acknowledges the threat of rising inflation and is confident in stabilizing the economy. The president also said that the price increase of certain goods and services due to inflation does not affect investment, production, and employment. According to him, his government's low rate policy is a part of a successful 'Economic Independence War. Presently, the result of the low rate policy is as Erdogan has expected: GDP increased by 7.4% in the third quarter of 2021. The Unemployment rate stood at 11.7%, down 0.4 points from the previous quarter. Exports increased by 25.6 percent in the third quarter of 2021 compared with the same quarter of 2020. But the expected inflation of 25% or higher is casting doubt on the currency stability that the government has promised. And whether or not the country will face hyperinflation remains a question till now. References linked below:

0 Comments

Leave a Reply. |

Send your articles to: |